Loading

Get Instructions Form Ct 3 Ac

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions Form Ct 3 Ac online

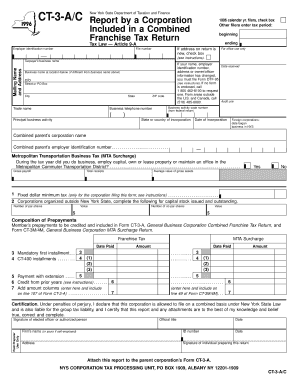

The Instructions Form Ct 3 Ac is essential for corporations filing as part of a combined franchise tax return in New York State. This guide will provide you with clear, step-by-step instructions to confidently fill out the form online.

Follow the steps to successfully complete the Instructions Form Ct 3 Ac.

- Access the form by clicking the ‘Get Form’ button. This will enable you to open the Instructions Form Ct 3 Ac in your preferred online form editor.

- Indicate if you are a 1996 calendar year filer by checking the appropriate box. If you're filing for a different tax period, enter the beginning and ending dates in the specified fields.

- Input your employer identification number. If your address has changed, check the corresponding box and provide the new information.

- Fill out the mailing name and address, including any 'c/o' information if applicable, ensuring that the business name and trade name are clearly stated.

- Enter the principal business activity and the business activity code number as listed on your federal return.

- If applicable, check the box indicating whether your corporation conducted business within the Metropolitan Commuter Transportation District and provide gross payroll, total receipts, and average value of gross assets in the designated fields.

- Complete the fixed dollar minimum tax calculations on line 1 based on your corporation's gross payroll. Ensure that you categorize and enter details regarding any prior year payments if required.

- Sign and date the form where indicated, providing your official title and preparer's information if applicable.

- After all fields are filled out, save your changes. You may choose to download, print, or share the completed form as needed.

Complete your Instructions Form Ct 3 Ac online today for a seamless filing experience.

You need to file your CT 3 in New York with the Department of Taxation and Finance, usually online or via mail, depending on your filing preference. Make sure to check the latest guidelines to ensure you send it to the correct address. Our Instructions Form Ct 3 Ac offers clear steps on where and how to file efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.