Get New York General Business Franchise Tax Return Fillable 2007 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York General Business Franchise Tax Return Fillable 2007 Form online

This guide provides a clear, step-by-step process for filling out the New York General Business Franchise Tax Return Fillable 2007 Form online. Whether you are familiar with tax forms or new to the process, you will find the necessary instructions to help you accurately complete the form.

Follow the steps to successfully complete your tax return online.

- Click ‘Get Form’ button to download the New York General Business Franchise Tax Return Fillable 2007 Form and open it in your preferred editing application.

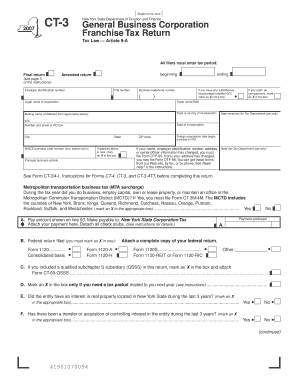

- Begin by entering the tax period at the top of the form. Specify whether this is the final return or amended return, and fill in the starting and ending dates for the tax period.

- Provide your employer identification number, file number, and business telephone number in the designated fields to identify your business.

- Fill in the legal name of the corporation as well as the trade name, if applicable. If the mailing name differs from the legal name, provide the mailing name too.

- Indicate the state or country of incorporation and the address associated with your business, including c/o, number and street or PO box, city, state, and ZIP code.

- Enter the NAICS business code number from your federal tax return and specify the principal business activity.

- Complete the income and deduction sections, carefully filling out each line as instructed. Provide all necessary information regarding federal taxable income, interest, and various deductions as structured in the form.

- Calculate the ENI (entire net income) base and fill in the required amounts in the corresponding lines. Be sure to attach any requested supplementary forms if applicable.

- Proceed to the computation of tax section; follow the instructions to accurately designate and calculate various taxes as required.

- Once all sections are completed, review your entries for accuracy. You can then save your changes, download a copy if needed, print, or share the completed form with the appropriate tax authorities.

Start filling out your New York General Business Franchise Tax Return online today!

Businesses operating within New York City are subject to the NYC general corporation tax, which applies to corporations based on their income and activity levels. This tax encompasses both domestic and foreign corporations doing business in NYC. Therefore, if your business is based in New York, ensure compliance with both city and state tax obligations, including the New York General Business Franchise Tax Return Fillable 2007 Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.