Loading

Get Char500 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Char500 Form online

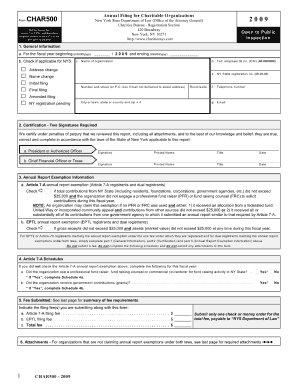

Completing the Char500 Form online can streamline your workflow and ensure accuracy in your submissions. This guide provides clear and detailed instructions to help you navigate each section of the form efficiently.

Follow the steps to complete the Char500 Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the personal information section. This includes your name, address, and contact details. Ensure all information is accurate to avoid any delays.

- Next, provide details related to the specific purpose of the form. Carefully read the prompts and input the necessary information according to what is requested.

- In the following section, you'll need to describe any relevant background information. Be thorough and concise to give a clear understanding of your situation.

- After completing all required fields, review your inputs for accuracy and completeness. Double-check your information to ensure everything is correct.

- Once you are satisfied with your entries, look for options to save your changes, download the form, print it, or share it as necessary.

Start filling out your Char500 Form online today to simplify your document management process.

Organizations that are registered as charities in New York State are required to file the NYS Char500 Form. This includes, but is not limited to, non-profit organizations, foundations, and faith-based entities. Filing this form is essential for maintaining legal compliance and public trust. If you're unsure about your organization's filing requirements, resources like US Legal Forms can provide guidance tailored to your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.