Loading

Get Tt 141a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tt 141a Form online

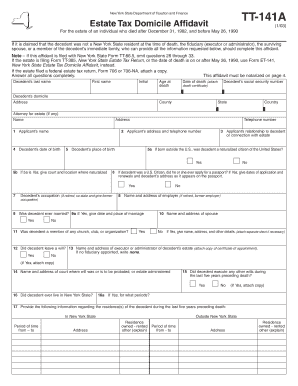

The Tt 141a Form serves as an estate tax domicile affidavit for individuals who passed away between December 31, 1982, and May 26, 1990. This guide provides comprehensive, step-by-step instructions for completing the form online, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to fill out the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the decedent’s last name, first name, and initial in the appropriate fields. Ensure all provided details are accurate and match official documents.

- Fill in the decedent’s domicile address, age at death, date of death, and county of residence, ensuring clarity and completeness.

- Record the decedent’s social security number and date of birth. This information is crucial for identification and verification purposes.

- Provide the applicant’s name, relationship to the decedent, and contact information. This confirms who is responsible for the form submission.

- Answer questions regarding the decedent’s citizenship status, passport applications, and marriage history. Attach necessary documents as stipulated.

- Detail the decedent’s residence history over the last five years, including any properties owned or rented, and ensure this information is thorough and well-documented.

- Indicate whether the decedent owned any real estate in New York State, including the property addresses and relevant dates, and complete any required follow-up questions concerning the properties.

- Complete the sections regarding the decedent’s financial activities, including tax filings, business engagements, and any legal proceedings they were involved in.

- Finish by providing a detailed list of all properties and assets under the decedent's name at the time of death, ensuring accurate valuation and documentation.

- Review the entire form for completeness and accuracy, making any necessary corrections before finalizing it.

- Save changes, download, print, or share the completed form as required, ensuring all copies are securely stored or submitted as necessary.

Start filling out your Tt 141a Form online today for a seamless submission process.

To obtain form 10IEA, check with your state's tax department or website for downloadable versions. This form is often used for income tax exemptions and can vary by state. If you want assistance with paperwork, US Legal Forms offers various resources, including the helpful Tt 141a Form, making the process easier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.