Loading

Get Nys 1 112 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYS 1 112 Form online

Filling out the NYS 1 112 Form online can be a straightforward process when you understand each component of the form. This guide will provide you with detailed and clear instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the NYS 1 112 Form online

- Click the ‘Get Form’ button to access the NYS 1 112 Form online and open it in the editor.

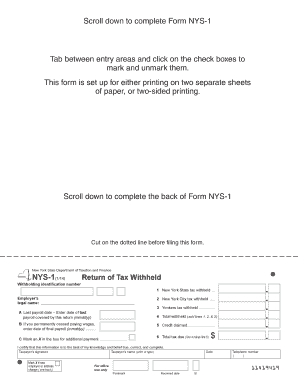

- Begin by entering your withholding identification number at the top of the form.

- In the 'Return of Tax Withheld' section, enter the amount of New York State tax withheld, New York City tax withheld, and Yonkers tax withheld in the respective fields.

- For the 'Last payroll date' field, specify the date of the last payroll covered by this return in the format mmddyy.

- Calculate the 'Total withheld' by adding the amounts entered in the previous step lines and enter the total in the designated field.

- If you have permanently ceased paying wages, note the date of your final payroll in the specified area.

- If applicable, mark an X in the box for additional payment and enter any credit claimed.

- Determine the 'Total tax due' by subtracting any credits claimed from the total withheld and enter this amount in the appropriate field.

- Certify the information provided is true, correct, and complete by signing the form and entering your name and telephone number.

- If you are using a paid preparer, have them complete the appropriate sections, including their signature and preparer’s information.

- Ensure all required information has been entered, review for accuracy, and follow instructions for mailing or submitting the form as necessary.

- Save any changes made to the form, and you can download, print, or share it as needed.

Complete your NYS 1 112 Form online today for a seamless filing experience.

Yes, as a nonresident of New York, you generally need to file a state tax return if you earn income sourced from New York. The NYS 1 112 Form may be relevant in this context as you navigate through the tax withholding process. Identifying your obligations is crucial to avoid penalties, and uslegalforms can assist with the necessary forms and guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.