Get Nh Cd 57

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nh Cd 57 online

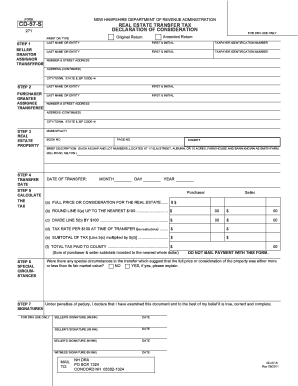

The Nh Cd 57, also known as the Real Estate Transfer Tax Declaration of Consideration, is an essential document used in the transfer of real estate in New Hampshire. This guide provides clear, step-by-step instructions for completing the form online, ensuring that you have all the necessary information at your fingertips.

Follow the steps to complete the Nh Cd 57 form successfully.

- Begin by obtaining the form electronically. Click the ‘Get Form’ button to access the Nh Cd 57 document in an editable format.

- In the first section, labeled 'Seller', enter the full name, address, and taxpayer identification number of the seller or transferor. If there are multiple sellers, ensure that you attach a supplemental schedule.

- Next, move to the 'Purchaser' section. Here, provide the complete name, address, and taxpayer identification number of the purchaser or transferee. Again, include a supplemental schedule if there are multiple purchasers.

- In the 'Real Estate Property' section, enter the relevant details including the municipality, book number, page number, county, and a brief description of the property being transferred.

- For the 'Transfer Date', specify the month, day, and year of the property transfer. This is essential for tax calculation.

- Proceed to the 'Calculate the Tax' section. Enter the full price or consideration paid for the property in the appropriate line. Follow the calculation steps provided to determine the tax owed based on the amount.

- If applicable, address any special circumstances that may affect the valuation of the property. Indicate if there are any special circumstances and provide a brief explanation.

- Finally, in the ‘Signatures’ section, ensure that all required signatures are completed in ink, along with the appropriate dates. This includes the seller(s)' and witness's signatures.

- Once all fields on the form are completed, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your real estate transfer documents online now for a straightforward filing experience.

New Hampshire tax forms are readily available online, primarily through the New Hampshire Department of Revenue Administration website. You can access various forms, including those relevant to property transfer and the NH CD 57. Additionally, the US Legal Forms platform offers easy-to-use templates and resources that simplify the process of obtaining and completing these forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.