Loading

Get Mi 1310

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi 1310 online

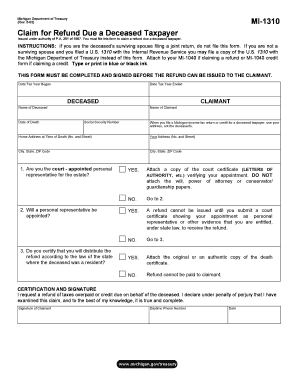

Filling out the Mi 1310 form is an important step for claiming a tax refund due to a deceased taxpayer. This guide aims to provide you with clear and detailed instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Mi 1310 form online.

- Click the 'Get Form' button to obtain the form and open it in the online editor.

- Input the tax year information by entering the date the tax year began and when it ended. This information is essential for identifying the correct tax period in question.

- Fill in the section for the deceased taxpayer. This includes providing the name of the deceased and the date of death.

- Complete the claimant's information by entering your name and Social Security number, as well as your home address at the time of death and your current address.

- Indicate whether you are the court-appointed personal representative for the estate. If you respond 'Yes', attach a copy of the court certificate verifying your appointment. If you respond 'No', you must provide a court certificate to receive the refund.

- If you are the personal representative, attach either the original or an authentic copy of the death certificate.

- Certify that you will distribute the refund according to the laws of the state where the deceased was a resident by selecting 'Yes' or 'No'.

- Sign the certification and signature section, declaring that the information provided is true and complete under penalty of perjury.

- Finally, enter your daytime phone number and date. Once all fields are completed, you can save changes, download, print, or share the form as needed.

Complete your documents online today for a streamlined process.

Processing a refund after filing a tax return can generally take between six to eight weeks. This timeline can fluctuate based on the IRS’s current workload and the accuracy of your submitted documents. For peace of mind, you can utilize IRS tools to track your refund progress and stay updated on your refund status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.