Loading

Get 5182923001 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5182923001 Form online

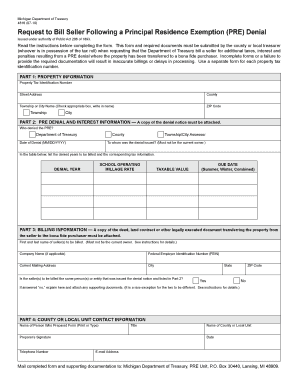

The 5182923001 Form, also known as the Request to Bill Seller Following a Principal Residence Exemption (PRE) Denial, is a crucial document for ensuring proper tax billing after a property sale. This guide provides clear, step-by-step instructions for completing the form online, making the process straightforward for users of all experience levels.

Follow the steps to complete the 5182923001 Form effectively.

- Click ‘Get Form’ button to obtain the form and access it for completion.

- In Part 1, enter the property information, including the property tax identification number, street address, county, and township or city. Ensure you provide a ZIP code.

- In Part 2, provide details regarding the PRE denial. Attach a copy of the denial notice, and include the name of the authority that issued the denial, the date of denial, and the person or entity to whom the denial was issued.

- Complete the table in Part 2 with the denied years, corresponding taxable values, school operating millage rates, and due dates. Be precise and thorough.

- Move to Part 3, where you will fill in the billing information for the seller(s). List their names, company name (if applicable), Federal Employer Identification Number, and current mailing address.

- Indicate whether the seller(s) listed is the same as the person or entity that received the denial notice. If not, provide an explanation and attach any necessary supporting documentation.

- In Part 4, complete the contact information for the person who prepared the form, including their name, title, telephone number, and email address.

- Review the entire form for completeness and accuracy. Once satisfied, save the changes, and if needed, download, print, or share the form.

Start your process and fill out the 5182923001 Form online today.

To get form 10ia, you can similarly visit trusted online platforms that specialize in legal and tax documents. US Legal Forms offers a simple process for finding forms like the 5182923001 Form and others. This way, you can ensure that you have the correct documentation needed for your tax filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.