Loading

Get Allowance Seminar Md Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Allowance Seminar Md Form online

This guide provides step-by-step instructions for completing the Allowance Seminar Md Form online. Whether you are new to digital document management or simply seeking clarity, this guide aims to help you navigate the form with ease.

Follow the steps to complete the Allowance Seminar Md Form online.

- Click ‘Get Form’ button to access the Allowance Seminar Md Form and open it in your chosen editor.

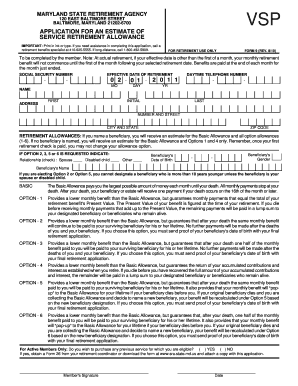

- Begin by filling in your personal information. This includes your name, address, and daytime telephone number. Ensure that you provide accurate details for effective communication.

- Indicate your social security number and desired effective date of retirement clearly to avoid processing issues.

- Review the various retirement allowance options provided. Choose the one that best suits your financial needs after considering the implications of each option on your beneficiary.

- If you are selecting Options 2, 3, 5, or 6, please provide details for your beneficiary, including their relationship to you, their date of birth, and gender.

- Read through the important notes and guidelines listed on the form. Make sure to understand the implications of your selections, especially regarding beneficiary relationships and any potential limits.

- Once all fields are filled out, review your entries for accuracy. Ensure all information aligns with the requirements outlined in the form.

- Finalize your submission by saving any changes made to the form. You can also choose to download, print, or share the completed form as needed.

Complete your Allowance Seminar Md Form online today for a seamless retirement planning experience.

MD Form 500 can be filed at your local Maryland tax office or electronically through the Maryland State Comptroller's website. Utilizing the Allowance Seminar Md Form can streamline your filing process by ensuring your information is accurate and complete. Make sure to double-check your forms for any missing information before submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.