Loading

Get Form 941bn Me

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941bn Me online

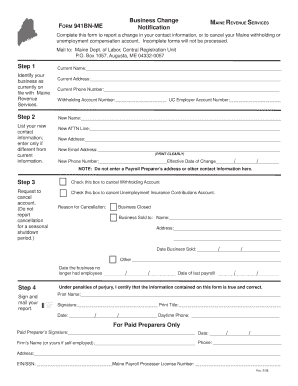

This guide provides comprehensive, step-by-step instructions for filling out the Form 941bn Me online. Whether you are reporting a change in contact information or canceling an account, this guide is designed to assist users with all necessary steps.

Follow the steps to complete the Form 941bn Me online.

- Click ‘Get Form’ button to download the Form 941bn Me and open it in your preferred editor.

- Identify your business as it is currently on file with Maine Revenue Services. Make sure to provide accurate details as requested: - Current Name - Current Address - Current Phone Number - Withholding Account Number - UC Employer Account Number After this, input your new information only if it has changed: - New Name - New ATTN Line - New Address - New Email Address - New Phone Number Finally, include the effective date of the change.

- Indicate if you are canceling your withholding account or unemployment insurance contributions account. Check the appropriate box for cancellation and provide a reason, which can include: - Business Closed - Business Sold (include the name and address of the buyer) - Other (specify) Also, date the sale of the business and indicate the date the business no longer had employees.

- Review all provided information for accuracy. Sign the form, include the date of the last payroll, and certify that the information is true and correct under penalties of perjury. Include your printed name, title, and daytime phone number. For paid preparers, fill out the additional required information, including the preparer’s name, date, firm name, phone number, address, EIN/SSN, and Maine Payroll Processor License Number.

- Once you have filled out the form completely, save your changes, and then download or print it for submission. Ensure that you mail the completed form to the Maine Department of Labor, Central Registration Unit at the address provided.

Get started on completing your Form 941bn Me online today.

To complete the W8BEN form, start by providing your personal information, including your name and country of citizenship. Follow by including any relevant tax identification numbers and claiming your foreign status. Make sure to review all sections carefully to ensure accuracy, particularly if you have obligations linked to Form 941bn Me. Many users find it easier to use resources like uslegalforms to navigate the process confidently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.