Loading

Get Form 941me

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941me online

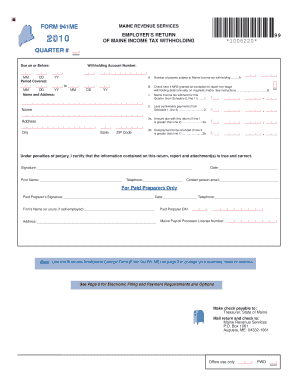

Filling out the Form 941me online is a straightforward process designed to help employers accurately report Maine income tax withholding. This guide provides step-by-step instructions to ensure you complete the form correctly and efficiently.

Follow the steps to successfully complete your Form 941me online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your withholding account number at the top of the form. Ensure this is accurate as it is vital for identification purposes.

- Indicate the quarter for the form being filed, by entering the start and end dates of the period covered.

- Provide the name and address information requested, ensuring that all details are correctly filled in to avoid processing delays.

- Complete Section A by listing the number of payees subject to Maine income tax withholding.

- In Section B, check the box if an exception was granted by the Maine Revenue Services to report non-wage withholding detail annually.

- Fill in the total Maine income tax withheld for the quarter in line 1, referencing the amount from Schedule 2, line 11.

- Record any semiweekly payments made in line 2, taken from Schedule 1, line 6.

- Calculate the amount due or overpayment by using lines 3a and 3b. Ensure these calculations are accurate.

- Provide your signature, printed name, telephone number, and date at the bottom of the form to certify that the information is true and correct.

- For paid preparers, complete the relevant sections including signature, date, telephone, and the firm’s name.

- Once all sections are thoroughly completed, save your changes. You may then download, print, or share the form as needed.

Ready to file? Complete your Form 941me online today.

Absolutely, filing your Maine state tax return online is a convenient option. You can use various online platforms that facilitate the filing of all required forms, including Form 941me. These platforms guide you through the filing process, allow you to track your submission, and often offer support if you encounter issues. This method enhances your filing experience and helps ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.