Loading

Get Form 5398

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5398 online

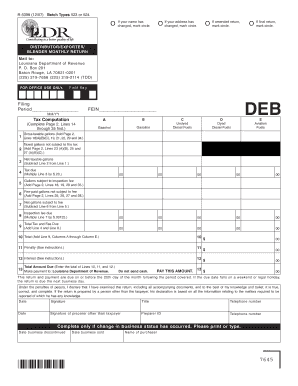

The Form 5398 serves as the distributor, exporter, or blender monthly return for specific fuel types. This guide will provide you with a clear and step-by-step approach to completing the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete the Form 5398 online.

- Click ‘Get Form’ button to initiate the process of obtaining the form and open it for editing.

- Begin by entering your taxpayer name. Ensure that this matches the name on your official documents for accuracy.

- Indicate the filing period for which you are submitting this return. This helps in tracking the relevant tax obligations.

- Proceed to the tax computation section by first filling in the gross taxable gallons for each type. This includes gasohol, gasoline, undyed diesel fuels, dyed diesel fuels, and aviation fuels, according to the data from page 2.

- Next, determine the tax due by multiplying the net taxable gallons by the applicable tax rate. You'll also need to calculate any inspection fees based on the specific gallons subject to these fees.

- Remember to review the declaration statement regarding the truthfulness of the submitted information. Include your signature and the date to ensure completion.

Complete your Form 5398 online today to ensure compliance with your tax obligations.

Filling out a 15CA form involves gathering information about your remittance and understanding the applicable rules regarding tax withholding. You must enter all necessary details, like the amount being sent and the purpose of the remittance. It’s crucial to ensure accurate data to avoid complications. For additional help with Form 5398 and related filings, uslegalforms can offer comprehensive support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.