Loading

Get What Is A Resident Trust In Louisiana It 541 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is A Resident Trust In Louisiana IT-541 Form online

Completing the What Is A Resident Trust In Louisiana IT-541 Form online can seem daunting, but understanding each section can simplify the process. This guide will provide clear and supportive instructions to help users accurately fill out the form.

Follow the steps to complete your IT-541 form effortlessly.

- Click the ‘Get Form’ button to retrieve the IT-541 form and open it in the editor.

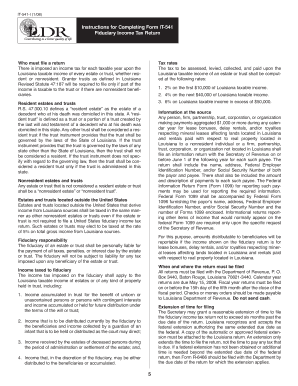

- At the top of the form, enter the Federal Employer Identification Number assigned by the Internal Revenue Service.

- Fill in the period covered by the return at the top of the page, stating the beginning and ending dates clearly.

- Complete Line 1 by inputting the federal taxable income before the income distribution deduction as reported on your federal Form 1041.

- Proceed to Line 2A and enter the net income tax paid to any state or political or municipal subdivision and print this amount.

- Continue to Line 3 to report any deductions, such as interest on U.S. government obligations or depletion exceeding federal depletion.

- Calculate your Louisiana taxable income by following the instructions on Lines 4 to 8 to determine your total taxable income.

- Thoroughly review the computed tax on Lines 9 to 12 to ensure accuracy before proceeding to the signature section.

- Ensure the return is signed either by the individual or authorized officer of the organization controlling the income.

- Finally, review all entries, save your changes, download a copy of the completed form, print it, or share it as necessary.

Start completing your IT-541 form online today to ensure a smooth filing process.

Determining whether a will or trust is better depends on your specific circumstances. A trust often offers advantages such as avoiding probate and providing asset management during your lifetime. However, a will may suffice for simpler estates. Understanding What Is A Resident Trust In Louisiana It 541 Form can help you make an informed choice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.