Get Irs Form 1120 H And Cift 620

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

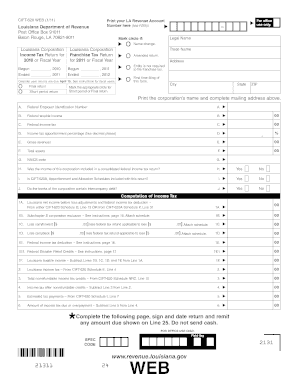

How to use or fill out the IRS Form 1120 H and CIFT 620 online

Filling out IRS Form 1120 H and CIFT 620 can be straightforward when approached methodically. This guide provides clear, step-by-step instructions to ensure you accurately complete each section of the forms online.

Follow the steps to complete your IRS Form 1120 H and CIFT 620 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your Louisiana Revenue Account Number in the designated field at the top of the form.

- Indicate the type of return by marking the appropriate circle for 'Final return,' 'Short period return,' or others as applicable.

- Complete the sections for federal identification information, including your Federal Employer Identification Number (FEIN) and federal taxable income.

- Provide the corporation’s total income, assets, and applicable NAICS code in the respective fields.

- Answer the questions regarding consolidated federal income tax returns and the inclusion of CIFT-620A schedules as instructed.

- Fill out the income tax computation section, detailing deductions, credits, and net income calculations as required.

- Complete the franchise tax computation based on the capital stock and other financial data from applicable schedules.

- Make sure to sign and date the return. A preparer's signature is required if applicable.

- Review all entries for accuracy before saving your changes. Once completed, download or print the form for your records or submission.

Start filing your IRS Form 1120 H and CIFT 620 online now for a smooth tax filing experience.

Completing IRS Form 8995 involves providing information related to your qualified business income, as well as related deductions. This form can be essential for individuals and entities claiming the Qualified Business Income deduction. To maximize your understanding of IRS Form 1120 H and CIFT 620 while filling out Form 8995, consider seeking guidance from platforms like uslegalforms. They offer resources and tools that simplify the filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.