Get Tax Exempt Form R 1392 511

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Exempt Form R 1392 511 online

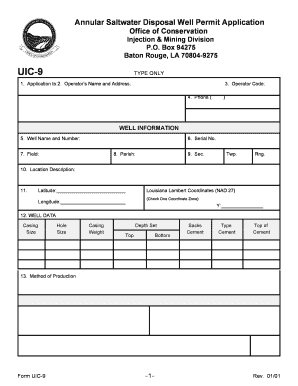

Filling out the Tax Exempt Form R 1392 511 online can be a straightforward process when approached step-by-step. This guide will assist you in understanding each section of the form, ensuring that you provide the necessary information accurately and completely.

Follow the steps to fill out the Tax Exempt Form R 1392 511 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section 1, provide your application details, specifically indicating whether you are applying for an initial permit or a re-permit.

- Fill in the operator's name and address in section 2. Ensure all details are accurate to avoid delays in processing.

- In section 3, enter your operator code, which is essential for identification.

- Provide your contact number in section 4, formatted correctly.

- For the well information in sections 5 to 10, accurately input the well's name, number, serial number, field, parish, and the location description, including the latitude and longitude.

- Complete section 11 by marking the appropriate coordinates and indicating the coordinate zone you are working in.

- In section 12, provide detailed well data including casing size, hole size, casing weight, and cement specifications. Make sure to fill in all relevant fields.

- Answer the questions in section 13 about the method of production by marking the applicable choices.

- Fill out section 14 and 15 regarding daily production rates and indicate if there are any untested zones in section 16.

- Continue to answer all yes/no questions in sections 17 to 21 and provide any required explanations.

- In sections 22 to 26, provide responses about alternate methods and costs related to the disposal.

- Section 27 requires you to name an agent or contact person for this application. Provide their contact details.

- In the certification section, fill in your name, title, sign, and include the date in sections 28 to 31 to verify the information provided.

- Once all sections are completed, review for accuracy, and save your changes, download, print, or share the form as needed.

Start filling out the Tax Exempt Form R 1392 511 online today to ensure a smooth application process.

Obtaining a tax exempt certificate in Louisiana involves completing the appropriate application process. You typically need to submit the Tax Exempt Form R 1392 511 along with any required documentation that proves your eligibility. Once approved, this certificate will allow you to make tax-exempt purchases. Always ensure you keep your records organized and current to avoid any issues.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.