Loading

Get Iowa Estimated Tax Forms Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iowa Estimated Tax Forms Fillable online

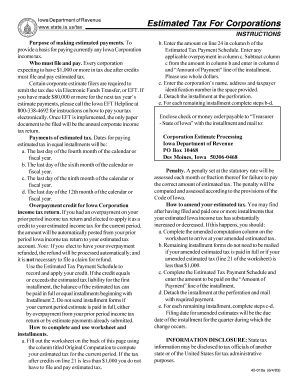

This guide provides users with a clear and structured approach to completing the Iowa Estimated Tax Forms Fillable online. Whether you are a corporation expecting to pay taxes or are helping someone else, these instructions will support you throughout the process.

Follow the steps to complete your Iowa estimated tax forms accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the Original Computation section on the worksheet to compute your estimated tax for the current period. This includes entering your net income from the federal return, adjustments for overpayments, and other necessary tax components.

- Enter the amount calculated on line 21 in column b of the Estimated Tax Payment Schedule. Additionally, if you are applying any overpayment, record that amount in column c.

- Calculate your net payment by subtracting the amount in column c from the amount in column b. This figure should also be entered in the ‘Amount of Payment’ line of the installment form.

- Provide the corporation's name, address, and taxpayer identification number in the appropriate spaces on the form.

- Detach the installment form at the perforation for submission.

- For each subsequent installment, repeat steps 3 to 6 as necessary for your payments.

- After completing the forms, you can save changes, download, print, or share your completed forms as needed.

Start completing your Iowa Estimated Tax Forms online now for a smooth filing experience.

The form number for the Iowa sales tax return is 71-710. This form is crucial for businesses collecting sales tax in Iowa to report the tax they owe. If you're handling sales tax calculations, using Iowa Estimated Tax Forms Fillable can make the filing process much simpler and more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.