Loading

Get Persi Cash Out Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Persi Cash Out Form online

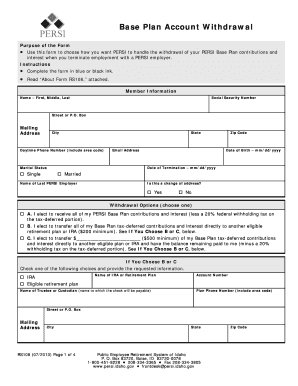

The Persi Cash Out Form is essential for users who wish to withdraw their contributions and interest from the PERSI Base Plan after leaving their employment. This guide provides step-by-step instructions for completing the form online, ensuring a smooth and efficient process.

Follow the steps to fill out the Persi Cash Out Form accurately.

- Click ‘Get Form’ button to access the Persi Cash Out Form online and open it in your preferred editor.

- Begin by providing your member information. Fill in your name (first, middle, last), social security number, mailing address, daytime phone number, marital status, email address, date of birth, and date of termination. Ensure all details are correct as this information is crucial for processing your request.

- Indicate your withdrawal option by selecting one of the available choices. You can either receive all contributions and interest, transfer all contributions, or select a partial transfer with remaining payments. Make sure to provide the necessary information corresponding to your chosen option.

- If you have chosen to transfer funds, complete the designated fields for the name of the IRA or retirement plan, account number, and the name of the trustee or custodian. Provide their contact information accurately.

- In the member acknowledgment section, certify that the information provided is accurate and that you understand the implications of your withdrawal, including the termination of your PERSI membership.

- Sign and date the form. If you are married, ensure your spouse also acknowledges and signs the form to provide their consent. Notarization is required for both signatories.

- After completing all sections, review the form for errors and ensure all signatures are notarized. Save changes to the form as needed, and consider downloading or printing the completed document for your records.

- Finally, submit the completed form to PERSI as per the instructions provided on the document. Make sure to send only the required pages.

Start completing the Persi Cash Out Form online now to manage your PERSI contributions effectively.

Yes, Idaho does tax 401k withdrawals as regular income. Therefore, when planning your withdrawal, it’s crucial to consider the potential impact on your tax situation. Utilizing the Persi Cash Out Form can streamline this process and help you understand the tax implications associated with your retirement funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.