Loading

Get Form 200 02

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 200 02 online

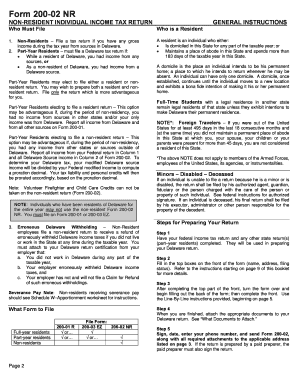

Filling out Form 200 02 online can streamline your tax filing process, ensuring accuracy and efficiency. This guide will provide you with step-by-step instructions to navigate the form effortlessly.

Follow the steps to complete your Form 200 02 successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Have your federal income tax return and any other state return(s) completed, as they will be used to prepare your Delaware return.

- Fill in the top boxes on the front of the form, including your name, address, and filing status. Refer to the specific instructions provided to ensure accuracy.

- After completing the upper portion of the front, turn the form over and start filling out the back. Use the line-by-line instructions to guide you through the fields.

- Attach any required documents, such as W-2s and 1099s, to your Delaware return to support your claims.

- Finally, sign and date the form, include your phone number, and send Form 200-02 along with all necessary attachments to the address specified in the instructions.

- Once you're finished, save your changes, download a copy of your completed form, or print it for your records.

Complete your Form 200 02 online today for a more efficient tax filing experience.

Related links form

To download a filed return, you will typically need access to your filing account on our platform. If you've submitted your Form 200 02 through our services, you can log in and navigate to your submitted documents. There, you can locate and download your filed return quickly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.