Loading

Get Form W1 9301

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W1 9301 online

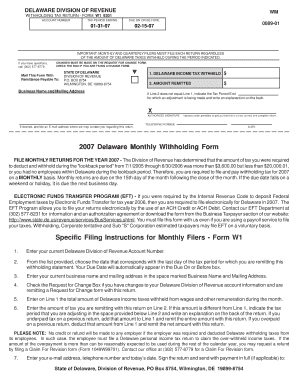

Filling out Form W1 9301 online is an essential task for individuals and businesses in Delaware managing their withholding tax obligations. This guide aims to provide clear, step-by-step instructions to help you navigate the form with ease.

Follow the steps to complete your Form W1 9301 correctly

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your current Delaware Division of Revenue account number in the designated field.

- Select the date that corresponds with the last day of the tax period for which you are submitting this withholding statement. The due date will automatically populate in the Due On or Before box.

- Fill in your business name and mailing address in the appropriate section labeled Business Name and Mailing Address.

- If applicable, check the box for Request for Change if you are submitting a Change Form along with this return.

- On Line 1, enter the total amount of Delaware income taxes withheld from wages and other payments during the specified month.

- On Line 2, input the amount of tax you are remitting with this return. If this amount differs from Line 1, indicate the tax period being adjusted below Line 2 and provide an explanation on the back of the form.

- Enter your email address, telephone number, and the date of submission. Make sure to sign the return.

- Submit your completed form along with payment, if necessary, to the State of Delaware, Division of Revenue, P.O. Box 8754, Wilmington, DE 19899-8754.

Complete your Form W1 9301 online today to ensure timely payment and compliance with tax obligations.

Related links form

Yes, you can e-file Form 8804, which is designed for withholding tax on partnerships. It is important to ensure that your information aligns with what is required on Form W1 9301 for seamless processing. E-filing offers convenience and faster processing times compared to traditional methods. Using platforms like USLegalForms can assist you in accurately completing and submitting your e-filing with ease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.