Loading

Get De W1a 9301

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the De W1a 9301 online

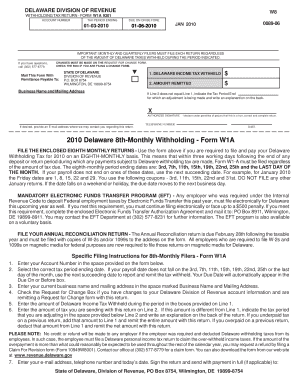

Filling out the De W1a 9301 form online is a crucial step in managing your Delaware withholding tax responsibilities. This guide provides clear instructions on each part of the form, helping users to complete it accurately and efficiently.

Follow the steps to successfully complete the De W1a 9301 form.

- Press the 'Get Form' button to access the form and open it in your preferred document editor.

- Enter your account number in the designated space at the top of the form.

- Choose the correct tax period ending date from the options provided. If your payroll date does not align with the specified dates, select the next succeeding date.

- Fill in your business name and mailing address in the 'Business Name and Mailing Address' section.

- If applicable, check the box indicating that you are filing a request for change regarding your Delaware Division of Revenue account information.

- Input the total amount of Delaware income tax withheld during the specified period into Line 1 of the form.

- Record the amount you are remitting on Line 2. If the amounts on Line 1 and Line 2 are not the same, provide the tax period for any adjustments and include an explanation on the back of the form.

- Provide your email address, telephone number, and the date on which you are filling out the form.

- Sign the return to confirm its accuracy and completeness.

- Submit the form along with any required payment to the State of Delaware, Division of Revenue, at the specified address.

Complete your De W1a 9301 form online today to ensure compliance with Delaware tax regulations.

Delaware does tax non-residents on income generated within the state. However, there are specific exemptions depending on your circumstances. If you are unsure about your situation, personal consultation can be invaluable. The De W1a 9301 service simplifies this process and offers clear guidance on tax liabilities for non-residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.