Loading

Get Delaware Form 300

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware Form 300 online

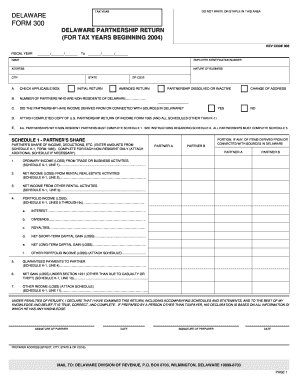

Filling out the Delaware Form 300 is an essential task for businesses operating in Delaware. This guide will provide you with clear, step-by-step instructions to successfully complete this form online, ensuring that you have all the necessary information at hand.

Follow the steps to complete the Delaware Form 300 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the tax year and fiscal year details at the top of the form. Fill in the start and end dates in the specified format.

- Provide the partnership’s name, employer identification number, address, and nature of business. Ensure that the city, state, and zip code fields are accurately completed.

- Select the applicable box to indicate whether this is an initial return, amended return, or if the partnership has been dissolved or is inactive.

- Indicate the number of partners who are non-residents of Delaware in the designated section.

- Answer the question regarding whether the partnership had income derived from or connected with sources in Delaware.

- Attach a completed copy of the U.S. Partnership Return of Income (Form 1065) and all required schedules other than K-1, as specified.

- Complete Schedule 1 for each non-resident partner, entering amounts from Schedule K-1, Form 1065 for various income categories.

- If applicable, complete Schedule 2 for apportionment percentage, detailing the property, wages, and gross receipts related to Delaware.

- For Schedule 3, list each partner's information. If more than five partners, attach an additional continuation schedule.

- Sign the return under penalties of perjury and date it. If prepared by someone other than the taxpayer, include their information as well.

- Finally, review the completed document for accuracy before saving changes, downloading, printing, or sharing the form as needed.

Start filling out your Delaware Form 300 online today!

In Delaware, partnerships engaged in business must file a partnership return, regardless of whether they owe taxes. All partnerships, limited liability companies, and LLCs taxed as partnerships must comply with this requirement. Properly completing your partnership return, perhaps using the Delaware Form 300, ensures adherence to state laws and helps avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.