Loading

Get Wreq 0089 99

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wreq 0089 99 online

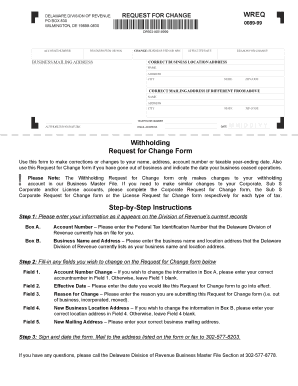

Filling out the Wreq 0089 99 is essential for making necessary changes to your business's information with the Delaware Division of Revenue. This guide provides clear, step-by-step instructions to help you complete the form accurately.

Follow the steps to successfully complete the Wreq 0089 99 online.

- Click the ‘Get Form’ button to access the Wreq 0089 99 and open it for editing.

- Please enter your information as it appears on the Division of Revenue’s current records in Box A. Account Number and Business Name and Address must be filled out correctly.

- In Field 1, if you wish to make a change to your Account Number listed in Box A, please enter the correct account number. If there is no change, leave Field 1 blank.

- In Field 2, provide the Effective Date you want the changes to take effect.

- In Field 3, enter the Reason for Change, such as if the business has gone out of business, was incorporated, or has moved.

- In Field 4, if you want to update the location address in Box B, enter the correct New Business Location Address. If there is no change, leave Field 4 blank.

- In Field 5, enter your correct New Mailing Address.

- Finally, sign and date the form. It can be mailed to the address on the document or faxed to 302-577-8203.

Complete your document online today and ensure your business information is accurate.

You typically need to fill out a W-8BEN if you are a non-U.S. individual receiving income from U.S. sources and want to ensure you are taxed correctly. This form is essential for claiming any potential tax treaty benefits available to you and prevents unnecessary withholding on your income. In cases of uncertainty, utilizing platforms like uslegalforms can guide you in navigating this requirement effortlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.