Loading

Get Co 1210 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Co 1210 Form online

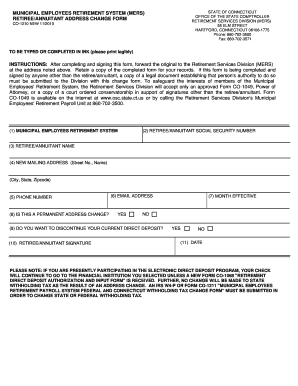

The Co 1210 Form is essential for updating your mailing address within the Municipal Employees Retirement System in Connecticut. This guide will take you through the process of completing this form online, ensuring that your information is accurate and up-to-date.

Follow the steps to complete the Co 1210 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security number in the designated field to verify your identity.

- Provide your full name as it appears on official documents in the 'Retiree/Annuitant Name' field.

- Input your new mailing address, ensuring to include the street number, name, city, state, and zip code.

- Fill in your contact information, including your phone number and email address for communications.

- Indicate whether this change is permanent by selecting 'Yes' or 'No' in the corresponding section.

- If you wish to discontinue your current direct deposit, select 'Yes' or 'No' accordingly.

- Sign the form to confirm that the information provided is accurate and complete.

- Enter the date of signature to finalize your submission.

- Once all fields are filled out, review the information and either save, download, print, or share the form as needed.

Start filling out your Co 1210 Form online today to ensure your information is updated.

The ITR form for individuals varies based on income types and levels. Generally, residents may choose from several forms, including the well-suited ITR Form 1. In some cases, individuals might find the Co 1210 Form beneficial for specific income categories, helping to streamline the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.