Loading

Get Form Ct 4852

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT 4852 online

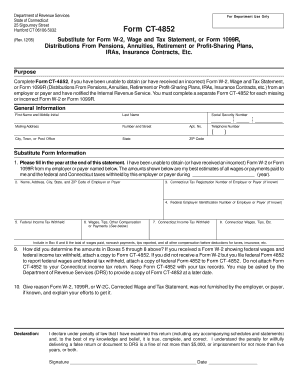

Filling out Form CT 4852 is essential if you have not received or have received incorrect wage or tax statements from your employer or payer. This guide will walk you through the process of completing this form online, ensuring that you provide the necessary information accurately and efficiently.

Follow the steps to successfully complete Form CT 4852.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your social security number at the top of the form. This is a crucial identifier for your tax records.

- Fill in your mailing address, including the number and street, apartment number (if applicable), city or town, state, and ZIP code.

- Provide your last name, first name, and middle initial to confirm your identity on the form.

- Next, enter your telephone number in the designated field. This is important for DRS to contact you if needed.

- Indicate the year for which you are completing the form at the end of the statement.

- Fill in the name, address, city, state, and ZIP code of your employer or payer from whom you are missing the W-2 or 1099R.

- If known, enter the Connecticut tax registration number of the employer or payer.

- If applicable, provide the federal employer identification number of the employer or payer.

- Record the amount of federal income tax withheld, along with your wages, tips, or other compensation.

- Include the Connecticut income tax withheld and the total Connecticut wages, tips, etc.

- Explain how you determined the amounts in the previous boxes and mention if you have any attachments like the federal Form 4852.

- State the reason why your Form W-2 or 1099R was not provided and detail any efforts you made to obtain it.

- Finally, sign and date the form, confirming that the information you provided is true and accurate.

- After completing the form, you can save changes, download it, print it, or share it as needed.

Ensure your tax records are accurate by completing Form CT 4852 online today.

To register for CT withholding tax, you must complete the registration process online via the Connecticut Department of Revenue Services. This process involves providing your business information and specifying your withholding requirements. Ensuring correct registration will benefit you when filing related forms, including Form Ct 4852.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.