Loading

Get Ct 8379

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 8379 online

Filling out the Ct 8379 form online can streamline your process of claiming a refund for nonobligated spouses. This comprehensive guide will provide you with clear and concise instructions to complete the form efficiently.

Follow the steps to complete the Ct 8379 online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

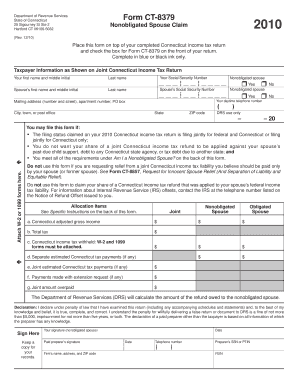

- Provide taxpayer information as it appears on your joint Connecticut income tax return, including your first name, middle initial, last name, and Social Security Number.

- Enter your spouse’s first name, middle initial, last name, and Social Security Number.

- Indicate if you are a nonobligated spouse by selecting 'Yes' or 'No.'

- Provide your daytime telephone number and mailing address including the apartment number or PO box, city or town, state, and ZIP code.

- Refer to the section on 'Am I a Nonobligated Spouse?' and confirm that you meet all specified criteria.

- Fill in the allocated amounts for Connecticut adjusted gross income, total tax, Connecticut income tax withheld, separate estimated tax payments, joint estimated tax payments, and any payments made with extension requests as required.

- Complete the declaration statement, signing and dating the form as the nonobligated spouse.

- Attach copies of all W-2 and 1099 forms showing Connecticut income tax withheld.

- Review your form for accuracy, then save your changes; you can also download, print, or share the completed form.

Complete your documents online to ensure a smooth filing process.

To file form 8379 electronically, you can use tax software that supports the e-filing of this form. Fill out the Ct 8379 section carefully, ensuring all required information is included. After reviewing your details, submit your return through the chosen software. This method streamlines your filing process and enhances the chances of a quicker refund. For additional help, consider uslegalforms to guide you through the steps.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.