Get Form Ct 8857

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-8857 online

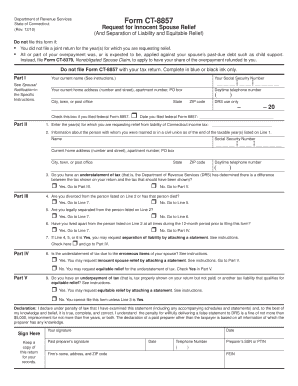

Filling out Form CT-8857, the Request for Innocent Spouse Relief, can seem daunting. This guide aims to provide clear, step-by-step instructions to help you successfully complete the form online, ensuring that you understand each component and how it pertains to your situation.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter your current name, Social Security Number, home address, and daytime telephone number. Make sure the information is accurate, especially if any of these details have changed since filing your joint tax return.

- In Part II, specify the year(s) for which you are requesting relief. Enter the name and Social Security Number of your spouse or partner as of the end of those taxable years.

- Address the questions in Part III concerning the separation of liability. Indicate if you are divorced, legally separated, or have lived apart for the past 12 months.

- If applicable, provide a statement for your request for separation of liability or explain any erroneous items related to the understatement of tax in Part IV.

- In Part V, if necessary, attach a detailed explanation for your request for equitable relief, addressing the specific circumstances that justify this request.

- Complete the declaration section, ensuring that you provide your signature and the date. If applicable, include the signature of your paid preparer.

- Finally, save your changes, download the completed form, and print it for your records before mailing it to the Department of Revenue Services.

Take action now to complete and submit your Form CT-8857 online!

Get form

The primary form used for innocent spouse relief is Form 8857, officially known as the Request for Innocent Spouse Relief. This form allows you to explain your circumstances and request protection from joint tax liabilities. Successfully completing this form is essential to ensure that you can clearly communicate your claims to the IRS. By utilizing resources available on platforms like uslegalforms, you can simplify this process and ensure all necessary information is provided.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.