Loading

Get Dr0252

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr0252 online

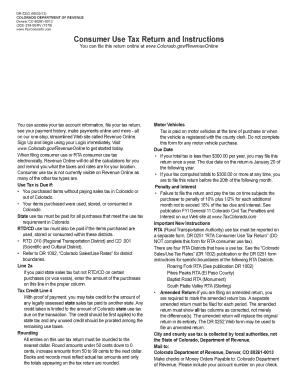

Filling out the Dr0252 online can be a straightforward process when you follow the right steps. This guide will provide you with clear instructions to ensure that you complete your Consumer Use Tax Return accurately and efficiently.

Follow the steps to complete your Dr0252 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information in the Purchaser section. This includes the business name, street address, city, state, ZIP code, county, and phone number. If you are an out-of-state taxpayer, provide your Colorado address as well.

- Fill in the account number and the period covered in MM/YY format. Ensure the correct dates are used to avoid any discrepancies.

- Complete Line 1a by listing purchase invoices covering the tangible property included in this return. If necessary, attach a separate sheet of paper detailing the invoices.

- Provide the invoice date and the name of the vendor in the respective fields. Mark the box if you are filing an Amended Return.

- Enter the total from your attachments in Line 1b. Ensure this amount reflects all additional documents.

- Calculate the taxable amount for Line 1c by adding the amounts from Line 1a and Line 1b.

- If you are claiming any purchases on which tax has already been paid, indicate this amount in Line 2a.

- Determine the taxable amount for Line 2b by subtracting Line 2a from Line 1c.

- On Line 3, apply the tax rate appropriate to your purchases. Ensure you are using the correct rates as provided in the instructions.

- If applicable, complete Line 4 to claim any tax credit for previously paid state sales tax with proof of payment.

- Calculate the net tax due in Line 5 by applying deductions as necessary. Make sure to follow instructions for rounding amounts.

- Complete Lines 6 and 7 for any penalties or interest due, if applicable.

- In Line 8, sum the total of tax due from all previous lines.

- Finally, review all entries, save your changes, and choose to download or print your completed form for your records.

Begin the process of completing your Dr0252 online today.

To work out gross income, start by gathering all sources of income, including salaries, freelance work, and any additional revenue streams. Add these amounts together to find your total gross income. Utilizing Dr0252 can facilitate this calculation and make the process simpler.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.