Loading

Get 2008 Form 540

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Form 540 online

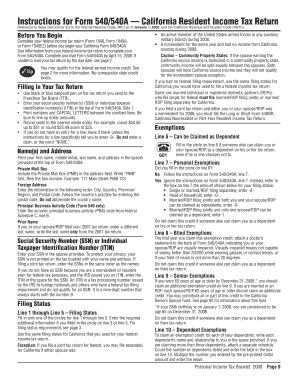

Filling out your 2008 Form 540 online is a straightforward process that ensures your California Resident Income Tax Return is completed accurately and efficiently. This guide provides you with step-by-step instructions to assist you in completing each section of the form.

Follow the steps to successfully fill out the 2008 Form 540 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Begin by entering your social security number(s) or individual taxpayer identification number(s) at the top of Form 540.

- Provide your full name, including first name, middle initial, and last name, along with your address, ensuring to follow the format stated for private mail boxes and foreign addresses.

- Select your filing status by filling in the appropriate circle on lines 1 through 5, ensuring it corresponds with your federal income tax return.

- Indicate if you can be claimed as a dependent on line 6, and if applicable, proceed to enter the personal exemptions on line 7, which you will calculate based on your specific circumstances.

- For lines 8 through 10, input information about any applicable blind exemptions, senior exemptions, and dependent exemptions, detailing each dependent’s name and relationship.

- Refer to your completed federal income tax return to report your state wages on line 12 and your federal adjusted gross income on line 13.

- Complete itemized deductions or opt for the standard deduction on line 18, ensuring you select the larger amount to minimize your taxable income.

- Calculate your tax on line 20 using the appropriate tax table or rate schedule based on your taxable income.

- Review all entries for accuracy, and then save, download, print, or share your completed Form 540 as necessary.

Take the initiative to complete your documents online for a more efficient and secure filing experience.

Generally, you do not need to attach your federal 1040 tax return to the 2008 Form 540. However, having a copy accessible can help you during the completion of your California return. If you have complex situations or special circumstances, it might be beneficial to consult with a tax professional.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.