Loading

Get Form 570

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 570 online

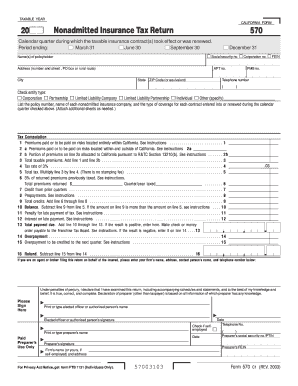

Filling out Form 570 online is an essential process for reporting nonadmitted insurance tax returns in California. This guide provides step-by-step instructions to help users navigate the form with clarity and ease.

Follow the steps to complete the Form 570 online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Select the taxable year for which you are filing the form. Ensure you choose the correct year from the options provided.

- Indicate the calendar quarter during which the nonadmitted insurance contract took effect or was renewed. Check the appropriate box for the quarter ending on March 31, June 30, September 30, or December 31.

- Enter the corresponding social security number, corporation number, and Federal Employer Identification Number (FEIN) in the designated fields.

- Input the name(s) of the policyholder, along with their address, city, state, and ZIP Code. If applicable, include the Private Mailbox (PMB) number.

- Provide your telephone number in the specified format.

- Check the entity type that applies to you by selecting the appropriate option: corporation, partnership, limited liability company, limited liability partnership, individual, or other.

- List the policy number and name of each nonadmitted insurance company along with the type of coverage for each contract entered into or renewed during the applicable calendar quarter. Attach additional sheets if necessary.

- Complete the tax computation section by entering the premiums paid for contracts located entirely within California and the total premiums paid or to be paid on contracts covering risks located within and outside California.

- Follow the instructions for lines relating to the allocation of premiums, penalties for late payment, and any applicable credits.

- Review the total amount due, ensuring you accurately complete lines for tax due, any overpayment, and the refund amount.

- Once all sections are filled out, save any changes to the form. You may download, print, or share the completed form as required.

Complete your Form 570 online today for a smooth filing experience.

Filling out the California state withholding form DE 4 requires you to gather important details about your income and personal situation. Begin by completing your information at the top of the form, then provide your allowances based on your needs. Take time to review the instructions provided to ensure accuracy. For added assistance, US Legal Forms offers resources that simplify this task.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.