Loading

Get Ar1000ec

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1000ec online

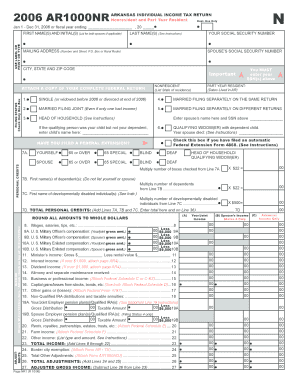

The Ar1000ec form is essential for individuals filing a nonresident or part-year resident Arkansas individual income tax return. Understanding how to complete this form accurately can help ensure compliance and accuracy in your tax filings.

Follow the steps to accurately complete your Ar1000ec form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name(s) and initial(s) in the designated section. If you are filing jointly, include your spouse's information as well.

- Fill in your mailing address, including street address, city, state, and ZIP code. Ensure this information is accurate for correspondence.

- Select your filing status by checking only one box that applies to you. Ensure you have entered your Social Security Number(s) above the selection.

- If you are a nonresident, indicate your state of residence. If you are a part-year resident, provide the dates you lived in Arkansas.

- Proceed to personal credits. Check any applicable boxes related to yourself or your spouse regarding age, blindness, or deafness.

- Input your income details by filling out the income sections, including wages, salaries, tips, and any other relevant income sources. Attach required documents.

- Continue to the adjustments section and ensure to subtract any applicable deductions from your total income.

- Calculate your tax by selecting the appropriate tax table and complete the calculations for credits and total payments.

- At the end of the form, review all entered information, save your changes, then download, print, or share the form as needed.

Complete your Ar1000ec form accurately and file it online today for a smooth tax experience.

The AR1000F form is used for individual income tax returns in Arkansas. It allows residents to report their income, claim deductions, and ensure compliance with state tax laws. When completing your tax documents, remember the Ar1000ec can simplify the process and help ensure you meet all requirements seamlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.