Loading

Get Ar4er Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar4er Form online

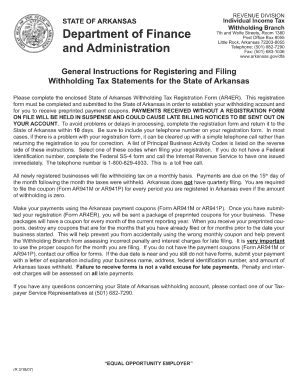

Filling out the Ar4er Form online can streamline your process and help you complete your submission efficiently. This guide provides step-by-step instructions to ensure you fill out each section accurately.

Follow the steps to complete your Ar4er Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin with the personal information section. Enter your full name, address, and contact information. Ensure that all details are correct and up to date.

- Proceed to the identification section. Here, you may need to provide an ID number or any other relevant identifiers necessary for your submission.

- Next, complete the details regarding your specific request or situation related to the Ar4er Form. Be as thorough and clear as possible to avoid delays.

- Review the terms and conditions related to your submission. It’s important to understand your rights and responsibilities before proceeding.

- After completing all necessary sections, carefully review the entire form for any errors or omissions.

- Once you are satisfied with the information provided, you can save your changes. You also have the option to download, print, or share the form as needed.

Get started on your Ar4er Form today for a seamless online filing experience.

Any resident or non-resident who earns income in Arkansas typically must file a state tax return. If you meet certain income levels or report specific deductions and credits, filing is required, and you might need the Ar4er Form. Make sure to verify your obligations with a trusted tax advisor or through UsLegalForms for expert assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.