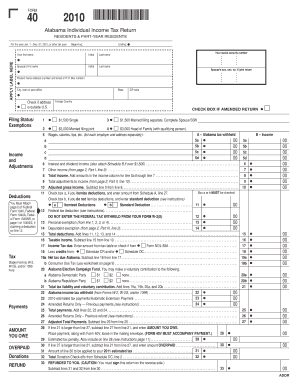

Get Late Alabama State Tax For 2010 Part Year Resident Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Late Alabama State Tax For 2010 Part Year Resident Form online

How to fill out and sign Late Alabama State Tax For 2010 Part Year Resident Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax, legal, corporate and additional documents necessitate a superior level of adherence to the legislation and safeguarding. Our templates are refreshed consistently in accordance with the most recent updates in regulations.

Moreover, with us, all the information you input in your Late Alabama State Tax For 2010 Part Year Resident Form is securely shielded from leakage or damage through advanced encryption.

Our platform enables you to carry out the whole process of submitting legal documents online. As a result, you save hours (if not days or even weeks) and avoid unnecessary expenses. From now on, file your Late Alabama State Tax For 2010 Part Year Resident Form from the convenience of your home, business office, or even while traveling.

- Access the document in the comprehensive online editor by clicking Get form.

- Complete the mandatory fields which are highlighted in yellow.

- Select the arrow labeled Next to transition from one field to the next.

- Utilize the e-signature feature to electronically sign the document.

- Enter the appropriate date.

- Review the entire electronic document to ensure you haven't overlooked anything.

- Click Done and download your new form.

How to Adjust Get Late Alabama State Tax For 2010 Partial Year Resident Form

Tailor forms online with confidence using a dependable document editing service.

Alter, complete, and validate Get Late Alabama State Tax For 2010 Partial Year Resident Form securely over the internet.

Too frequently, handling forms like Get Late Alabama State Tax For 2010 Partial Year Resident Form can be problematic, particularly if acquired in digital format without access to specialized resources. While workarounds exist, they may lead to a document that fails to meet submission standards. Relying on a printer and scanner is not an alternative either, as it consumes both time and resources.

We provide a more seamless and effective approach to filling out forms. A diverse selection of document templates that are simple to adjust and certify, and can be made fillable for various users. Our platform offers more than just a collection of templates. One highlight of our service is that you can modify Get Late Alabama State Tax For 2010 Partial Year Resident Form directly on our site.

Utilize the fillable fields option on the right to insert fillable fields. Click Sign from the top toolbar to create and include your legally-binding signature. Press DONE and save, print, share, or download the final product. Bid farewell to paper and other ineffective methods for handling your Get Late Alabama State Tax For 2010 Partial Year Resident Form or other documents. Opt for our solution that merges one of the most comprehensive libraries of ready-to-edit templates with a robust document editing feature. It's straightforward and secure, which can save you considerable time! Don't just take our word for it, explore it yourself!

- Being a web-based service, it spares you from installing any software program.

- Furthermore, not all company policies allow for installation on corporate computers.

- This is the best way to conveniently and safely finalize your documents with our platform.

- Click on the Get Form > to be taken directly to our editor.

- Once opened, you may commence the editing process.

- Choose checkmark or circle, line, arrow, and cross along with other options to annotate your document.

- Select the date option to incorporate a specific date into your template.

- Include text boxes, images, notes, and more to enhance the content.

States have various timeframes to collect back taxes, generally between three to fifteen years, depending on local laws. In Alabama, the limit is typically 15 years after the tax was assessed. Staying informed can help you avoid surprises. To navigate your obligations, consider using the Late Alabama State Tax For 2010 Part Year Resident Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.