Get Form 536

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 536 online

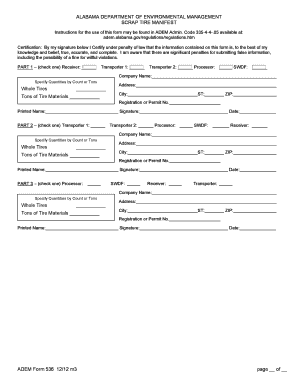

Filling out the Form 536 online is a straightforward process designed for those involved in the transportation of scrap tires in Alabama. This guide will walk you through each section of the form to ensure that all necessary information is submitted accurately and in accordance with regulations.

Follow the steps to fill out Form 536 effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part 1, select the appropriate checkbox for the role of the receiver. Provide the company name, mailing address, registration or permit number, and specify the quantities of whole tires or tons of tire materials being transported. Ensure to include a responsible party's printed name and signature.

- In Part 2, select the relevant checkbox for the transporter. Fill in the transporter or receiver’s company name, mailing address, registration or permit number, and detail the quantities of whole tires or tons of tire materials received. A responsible party's printed name and signature are also required.

- In Part 3, indicate the appropriate checkbox for the processor. Enter the processor’s company name, mailing address, registration or permit number, and note the quantities of whole tires or tons of tire materials accepted. Ensure the responsible party’s printed name and signature are included.

- Review all entries for accuracy before saving. Once you have confirmed that all information is correct, you can choose to save your changes, download the completed form, print it for records, or share it as needed.

Start completing Form 536 online today for efficient and compliant scrap tire management.

The tax debt hardship form is designed for individuals who face financial difficulties and need to request relief from IRS collections. Completing the necessary forms, including potentially Form 536, can help you communicate your situation effectively to the IRS. Understanding this form and the process involved can alleviate stress during challenging times. For expert help, rely on the resources available at uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.