Loading

Get Irs Form 50

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 50 online

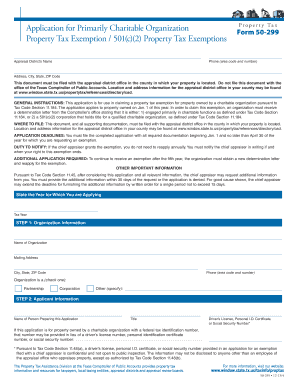

Filling out the IRS Form 50, which is the Application for Primarily Charitable Organization Property Tax Exemption, can seem daunting. This guide provides a step-by-step approach to help you complete the form online with ease and confidence.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify and enter the tax year for which you are applying for the exemption. This is critical for proper filing.

- Provide the organization information, including the name of the organization and its mailing address. Specify the type of organization by checking the appropriate box (Partnership, Corporation, or Other).

- Complete the applicant information section, including the name of the person preparing the application, their title, and either a driver’s license number, personal identification certificate number, or social security number. If using a federal tax identification number, provide that instead.

- Detail the property information by attaching a Schedule A form for each parcel of real property you wish to claim as exempt and a Schedule B for personal property. Ensure all schedules are completed accurately.

- Attach the Comptroller’s determination letter regarding the organization’s eligibility, as well as indicate if you have received a property tax determination letter from the Comptroller.

- In the certification and signature section, print the name and title, provide the authorized signature, and date the application. Be aware that false statements may result in legal penalties.

- Review the completed form for accuracy, then save your changes. You can then download, print, or share the form as needed.

Start completing your IRS Form 50 online today for an efficient filing experience.

You can obtain a standard Form 50 through the IRS website where all forms are readily available for download. Once on the site, you can search for Form 50 in the search bar. Additionally, US Legal Forms offers a comprehensive library of IRS forms, ensuring you have access to the most up-to-date versions. This resource can make the downloading and completion process easier for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.