Loading

Get St 810 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 810 Form online

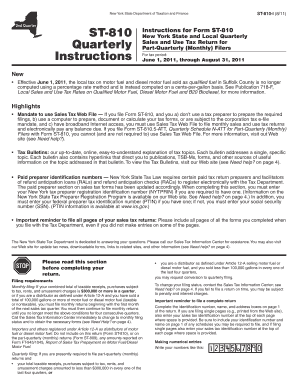

Filling out the St 810 Form online can streamline your tax reporting process. This guide provides a clear, step-by-step approach to help users understand each component of the form, ensuring accurate and efficient completion.

Follow the steps to successfully complete the St 810 Form online.

- Press the ‘Get Form’ button to obtain the St 810 Form and open it in your preferred editing tool.

- Begin by entering your sales tax identification number, name, and address in the required fields at the top of the first page. Ensure you provide accurate information to avoid processing issues.

- In Step 1, report your total gross sales and services in box 1. Include all taxable, nontaxable, and exempt sales, excluding sales tax. Double-check your figures to ensure accuracy.

- Proceed to Step 2 and identify any required schedules by referring to the descriptions on the front of the St 810 Form. Complete these schedules as needed before moving forward.

- In Step 3, calculate total sales and use taxes. If applicable, enter the amounts from any appended schedules in the appropriate boxes provided on page 2 of the form.

- Continue to calculate special taxes, including those related to passenger car rentals and other specific services, as outlined in Step 4. Ensure you multiply the taxable receipts by the correct percentage rates.

- Finalize the credits and advance payments in Step 5 by entering any applicable credits related to sales tax and summarizing these totals on the designated lines.

- For any penalties or interest that may apply due to late filing, reference Step 7, where you will account for any owed amounts in the relevant fields.

- Complete the final calculations to determine the total amount due for submission in Step 8. Verify each entry for correctness.

- Before filing, review the entire form for any mistakes or missing information. Once everything is correct, you can save your changes, download, print, or share the completed St 810 Form.

Ensure your tax compliance by completing and filing your documents online today.

Yes, it is essential to fill out the FATCA form if you meet the specific asset thresholds set by the IRS. Failing to do so may lead to significant penalties and legal consequences. Completing the St 810 Form ensures you remain compliant with tax obligations, protecting your financial interests. For convenience, you can find the necessary forms on U.S. Legal Forms, making the process straightforward.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.