Get Web Filing Instruction St 100 New York Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Web Filing Instruction St 100 New York Form online

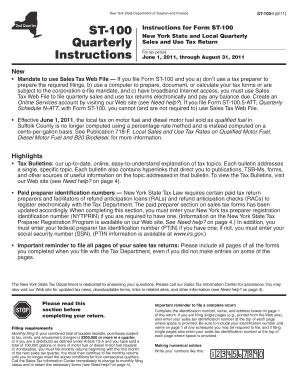

Filing the Web Filing Instruction St 100 New York Form is essential for reporting your quarterly sales and use tax accurately. This guide provides step-by-step instructions to help you navigate the online filing process efficiently, ensuring compliance while minimizing errors.

Follow the steps to complete the form successfully.

- Click 'Get Form' button to obtain the ST-100 form and open it in your online editor.

- Complete the identification section by entering your name, address, and New York State tax identification number. Ensure all entries are accurate as they are crucial for processing your return.

- In Step 1, enter your total gross sales and services in box 1. This includes taxable, nontaxable, and exempt sales but excludes sales tax.

- Identify the required schedules you need to complete, if any. Consult the brief descriptions provided in the form for clarity.

- Calculate your sales and use taxes based on the completed schedules and enter the totals in the corresponding boxes on page 2.

- Fill in any special taxes applicable, based on your business operations, followed by the credit for prepaid sales tax where applicable.

- Calculate the total amount due by adding and subtracting the relevant figures from previous steps.

- Sign the form and ensure all necessary attachments are included before submission. Confirm that you retain a copy for your records.

- File the completed form online as directed, ensuring that it is sent to the appropriate department for processing.

Begin completing your Form ST-100 online today to ensure your business stays compliant with New York tax regulations.

The ST-100 is a New York State sales tax return form that businesses use to report sales tax collected over a designated period. This crucial document outlines your total taxable sales and the amount of sales tax you owe. Understanding the Web Filing Instruction St 100 New York Form is essential for completing this task and ensuring proper compliance with state tax laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.