Get New York State St100 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State St100 Form online

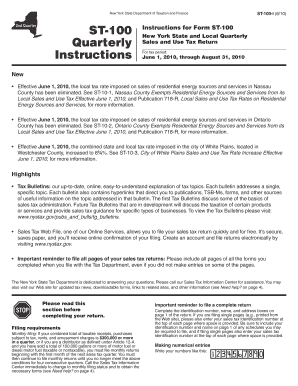

Filling out the New York State St100 Form online is a straightforward process designed to help users report their sales and use tax accurately. This guide provides clear, step-by-step instructions for navigating each section of the form effectively.

Follow the steps to complete the St100 Form with ease.

- Press the ‘Get Form’ button to access the St100 Form and open it in your editor or browser.

- Provide your identification number, name, and address in the designated boxes on page 1 of the form. Ensure that this information is accurate and matches your records.

- In Step 1, input your total gross sales and services, excluding sales tax. Be sure to include all taxable, nontaxable, and exempt sales from your New York State business and from outside the state where applicable.

- Identify the required schedules for your filing in Step 2. Read any brief descriptions provided on page 1 to determine what additional schedules may need to be completed.

- Calculate your sales and use taxes in Step 3. Enter the totals from any completed schedules and calculate taxes based on the appropriate jurisdictions.

- In Step 4, report special taxes if applicable, such as those for passenger car rentals and information services. Ensure that you calculate the correct tax amounts as required.

- Review and total any tax credits and advance payments claimed in Step 5. Be sure to keep documentation supporting these claims as you may need to submit them.

- Complete and sign the form in Step 8, providing your name, title, date, and contact information. If applicable, the preparer needs to sign and provide their details as well.

- Finally, save your completed form and decide if you will download, print, or share your submission for your records before filing it.

Take control of your tax responsibilities by filling out the St100 Form online today.

To mail your New York State income tax forms, always refer to the latest instructions provided by the New York State Department of Taxation and Finance. The mailing address can differ based on various factors, such as whether you include payment or are expecting a refund. Thoroughly checking the required address helps speed up processing. If you want to avoid confusion, UsLegalForms can provide assistance and access to correct templates for filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.