Loading

Get 2010 Form Ct 32

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form Ct 32 online

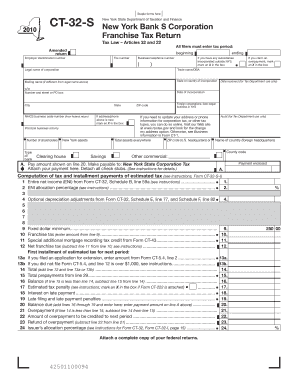

This guide will help users fill out the 2010 Form Ct 32 online with clarity and confidence. By following these steps, you will ensure that your tax return is completed accurately and efficiently.

Follow the steps to complete your 2010 Form Ct 32 online.

- Press the ‘Get Form’ button to access the 2010 Form Ct 32. This will open the form in the digital editor for you to start filling it out.

- Begin with line 1, where you will enter the entire net income as indicated on Form CT-32, Schedule B, line 59a. Make sure to refer to the instructions for accurate figures.

- For line 2, calculate and input your ENI allocation percentage based on the guidance provided in the accompanying instructions.

- On line 4, include any optional depreciation adjustments sourced from Form CT-32, Schedule E, line 77, or Schedule F, line 82.

- Enter the fixed dollar minimum amount on line 9; this should be populated as $250.00.

- Reflect the franchise tax amount from line 9 on line 10. Ensure it is calculated correctly.

- Input the special additional mortgage recording tax credit from Form CT-43 on line 11.

- For line 12, subtract line 11 from line 10 to find your net franchise tax.

- Lines 13a and 13b pertain to the first installment of estimated tax for the next period. Depending on your filing status with Form CT-5.4, complete these lines appropriately.

- Calculate the total by adding line 12 with either line 13a or line 13b and enter it on line 14.

- Add the total prepayments from line 29 on line 15.

- If line 15 is less than line 14, subtract line 15 from line 14 and enter the result on line 16.

- Indicate any estimated tax penalties on line 17, marking an X in the box if Form CT-222 is attached.

- Record any interest on late payments on line 18.

- Report any late filing and late payment penalties on line 19.

- Sum lines 16 through 19 and enter the total balance due on line 20.

- If applicable, indicate overpayments on line 21, calculating as line 15 minus line 14.

- Complete line 22 for the amount of overpayment to be credited to the next period.

- Finalize your refund of overpayment by subtracting line 22 from line 21 and enter it on line 23.

- Fill out any additional required information regarding the corporation such as legal name, mailing address, and contact information.

- Once all sections are carefully completed, you can save changes, download, print, or share the form based on your requirements.

Complete your documents online efficiently and experience seamless digital document management.

To obtain your CT 1040, visit the Connecticut Department of Revenue Services website where you will find downloadable forms. It also helps to keep your records aligned with the 2010 Form CT 32 to make sure you have all required information handy. Alternatively, if you prefer assistance, utilizing USLegalForms can streamline your tax preparation process efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.