Get St 1192 Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 1192 Instructions Form online

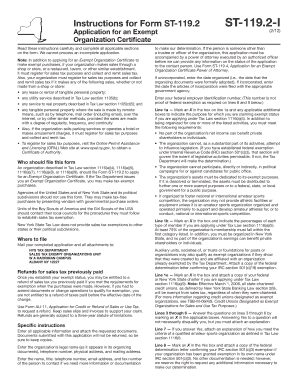

The St 1192 Instructions Form is essential for organizations seeking an Exempt Organization Certificate, allowing them to make tax-exempt purchases. This guide provides a clear, step-by-step approach to filling out the form online, ensuring users can complete their application efficiently.

Follow the steps to successfully complete the St 1192 Instructions Form online.

- Click ‘Get Form’ button to access the St 1192 Instructions Form and open it in your browser or editor.

- Begin by filling out the organization’s legal name, telephone number, physical address, and mailing address in the designated fields.

- Provide the contact person’s name, title, telephone number, email address, and fax number, ensuring the information is accurate for further communication if needed.

- If the organization is unincorporated, enter the date it was organized; if incorporated, input the date the articles of incorporation were filed.

- Enter the organization’s federal employer identification number in the appropriate field. Note that this number does not serve as proof of federal exemption.

- Mark an X in the relevant boxes on line 1a, indicating the purpose for requesting exempt status, and meet additional requirements if applicable.

- Complete lines 1b through 10 by marking applicable boxes and providing any necessary documentation as described, attaching copies of required documents.

- Prepare the statement of activities, including detailed descriptions of present and future operations, as well as the statement of receipts and expenditures.

- Have an officer of the organization sign and date the completed application to validate it.

- Once the form is filled out, review for completeness and accuracy. Save any changes made to the form, and prepare for submission.

Complete your application online to benefit from tax-exempt purchases.

In New York, the tax exempt form for tractor trailers is often related to the ST-120 form, which provides exemptions for various vehicles used for business purposes. You will need to ensure that your tractor trailer qualifies under the specific criteria outlined in the state tax regulations. For detailed instructions regarding the completion of tax exemption forms, consult the St 1192 Instructions Form. This ensures you have the correct documentation in place.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.