Loading

Get It 370 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-370 form online

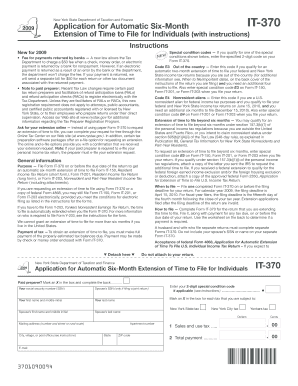

Filing the IT-370 form online allows individuals to request an automatic six-month extension to file their New York State income tax returns. This guide provides a clear, step-by-step approach to completing the form effectively and accurately.

Follow the steps to complete your IT-370 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information, including your name and social security number. If you are filing a joint return, include your partner's information as well.

- In the designated section, mark an ‘X’ for each tax type you are subject to, including New York State tax, New York City tax, and Yonkers tax.

- Provide your mailing address, ensuring all details such as street number, city, state, and ZIP code are accurately filled.

- If applicable, enter your 2-digit special condition code based on your eligibility for an automatic extended filing period.

- Complete the payment section by estimating your New York State income tax liability and recording any sales and use tax you owe.

- Review all entered information for accuracy before finalizing your form. Ensure no required fields are left blank.

- Once completed, save your changes and download or print the form as required. You may share it according to the filing regulations.

Complete your IT-370 form online today to ensure a timely request for an extension.

If you are a resident of New York City, you are generally required to file a New York City tax return in addition to your New York state tax return, which includes the IT-370 Form. However, certain income thresholds apply, so it's essential to check if you meet these requirements. Filing ensures that you remain compliant with city tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.