Get Form F0030 Subtemp06132011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form F0030 Subtemp06132011 online

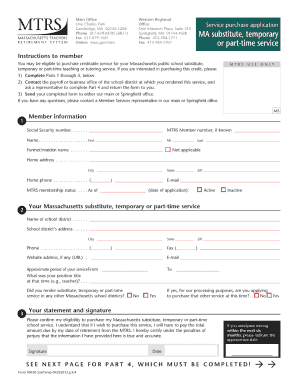

Filling out the Form F0030 Subtemp06132011 online can seem daunting, but this guide provides clear and supportive instructions for every step of the process. By following these steps, you will be able to complete the form accurately and efficiently.

Follow the steps to fill out the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin with the personal information section. Provide your full name, address, and contact details as required. Ensure that all information is accurate and up to date.

- Next, move to the identification section. This may include entering your date of birth and social security number. Double-check for accuracy to avoid any processing delays.

- Fill out any relevant sections regarding your current status or situation. Be clear and concise in your responses to facilitate understanding.

- Review any additional fields that may pertain to specific circumstances or requirements relevant to the form. If applicable, provide supplemental documentation as instructed.

- Once all required fields have been completed, take a moment to review the entire form for any missing information or errors.

- Finally, save your changes, and you can choose to download, print, or share the completed form as needed.

Start filling out your Form F0030 Subtemp06132011 online today and ensure all your information is ready and accurate.

When selecting a filing status on your W-4, consider your marital status and whether you will claim dependents. Typically, you can choose from options like single, married, or head of household, which will impact your tax liability. Accurately selecting your filing status ensures proper withholding and helps you avoid surprises during tax season. For clarity and assistance with your W4 choices, Uslegalforms can provide resources tailored to your situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.