Loading

Get Montana Ui

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Montana Ui online

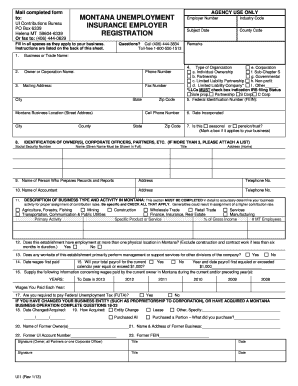

Filling out the Montana Unemployment Insurance Employer Registration form online is a straightforward process that requires careful attention to each section of the document. This guide provides step-by-step instructions to ensure that users can successfully complete the form, facilitating proper business registration in Montana.

Follow the steps to complete the Montana Ui form efficiently.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Begin filling in the business or trade name in the designated field.

- Provide the owner's or corporation's name, followed by the applicable phone number.

- Enter the mailing address, including street, city, state, and zip code, as well as the fax number if available.

- Input the employer number and the appropriate industry code based on your business activities.

- Indicate the county code and any relevant remarks in the provided sections.

- Fill out the specific location of the Montana business, including the street address.

- Select the type of organization from the options provided, ensuring that any applicable boxes are checked.

- Enter the Federal Identification Number (FEIN) in the specified field.

- Provide the date of incorporation and indicate if the business is seasonal or a pension/trust by marking the corresponding box.

- List the identification of owner(s), corporate officers, partners, etc., ensuring the social security number and full names are provided.

- Input the name, address, and telephone number of the person who prepares records and reports as well as the accountant's contact details.

- Describe the business type and activity in detail, ensuring all relevant categories are selected to minimize contribution rates.

- Indicate whether the establishment has employment at more than one physical location in Montana.

- Specify if the total payroll for the current calendar year will equal or exceed $1,000.

- Provide information on wages paid by the current owner in Montana during the current and preceding years.

- Indicate whether you are required to pay Federal Unemployment Tax (FUTA).

- If applicable, complete questions regarding any changes to your business entity and specify the date and nature of changes.

- Affix signatures from the owner, all partners, or one corporate officer, along with their titles and the date.

- Finally, review all entered information for accuracy before submitting.

Complete your documents online today for a seamless registration process.

In Montana, to qualify for unemployment benefits, you must have earned sufficient wages, be available for work, and actively seek employment. Additionally, you must be physically able to work and not refuse any suitable job offers. Meeting these requirements ensures that you can leverage the Montana UI system effectively for your benefit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.