Loading

Get Mshda Lender Online Access

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mshda Lender Online Access online

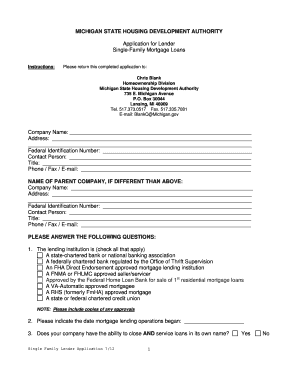

Filling out the Mshda Lender Online Access form can be a straightforward process when approached systematically. This guide provides detailed instructions on each section and field of the application, ensuring clarity and ease for users of all experience levels.

Follow the steps to successfully complete the Mshda Lender Online Access form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the company name in the designated field provided on the form.

- Fill in the address, ensuring to complete all sections accurately.

- Designate a contact person for your application, along with their title.

- If applicable, provide the name and address of the parent company, along with their federal identification number and contact details.

- Answer the multiple-choice questions regarding the status and operations of your lending institution by checking all relevant options.

- Respond to questions about your company's ability to close and service loans, providing ‘Yes’ or ‘No’.

- List all branches originating MSHDA loans in Michigan, ensuring to provide all required details.

- Specify the approximate annual originations for FHA, VA, RHS, and conventional loans, entering the estimated amounts.

- Confirm whether your company meets the net worth requirement and submit necessary documentation.

- Indicate your licensing status under the Michigan Mortgage Brokers, Lenders, and Servicers Licensing Act by providing the needed documentation.

- If applicable, indicate your capability to serve smaller communities in Michigan and list the proposed areas to cover.

- Include all requested documents with your application, ensuring to verify that they are up to date and correctly prepared.

- Once all sections are complete, review the form for accuracy before saving changes, downloading, printing, or sharing the form as needed.

Begin completing the Mshda Lender Online Access application online today for a smooth submission process.

You can contact Michigan Medicaid by visiting their official website, which provides comprehensive information and support. Alternatively, you can call their customer service line for assistance with enrollment and benefits. If you're exploring various financial assistance options, consider also checking out MSHDA Lender Online Access to find related housing resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.