Loading

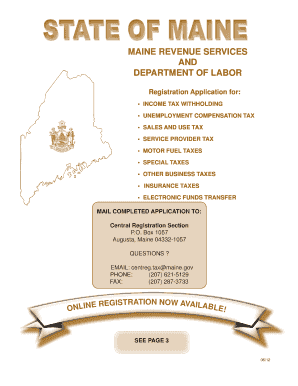

Get Maine Revenue Services And Department Of Labor Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maine Revenue Services And Department Of Labor Form online

Filling out the Maine Revenue Services And Department of Labor form online can streamline your registration process for various taxes. This guide provides you with step-by-step instructions, making it easier to navigate the necessary sections and complete the form efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, provide your taxpayer information. Enter your legal business name, trade name if applicable, social security or federal employer identification number, business phone number, and email address. Also, include your primary mailing address and the physical location of your business.

- Select the type of ownership that applies to your business in Section 1. If you have a sole proprietorship, ensure that you understand the requirements for tax registration.

- In Sections 2 through 10, check the specific tax types you are applying for (e.g., income tax withholding, unemployment compensation tax, sales and use tax, etc.). Complete each section relevant to your business operations.

- In Section 2, if applicable, enter the income tax withholding begin date and address for notices. Section 3 requires details about unemployment compensation tax filings.

- When completing Section 4 for sales and use tax, specify your registration date and the types of goods or services provided that are subject to tax.

- For the service provider tax in Section 5, enter the service details and select the appropriate filing frequency.

- Continue through Sections 6 through 10, providing necessary details about motor fuel taxes, special taxes, and insurance taxes as they apply to your business.

- Review all entries for accuracy and completeness to ensure prompt processing of your registration.

- Once you have filled out all relevant sections, save your changes. You can then download, print, or share the form as needed.

Complete your tax registration form online to ensure a smooth and efficient process.

In Maine, there is no specific age at which individuals automatically stop paying property taxes. However, some exemptions may apply based on age or disability status. It's good to consult local regulations or the Maine Revenue Services to explore any potential relief options, which may relate to the Maine Revenue Services And Department Of Labor Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.