Get Application For Louisiana Revenue Account Number Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Louisiana Revenue Account Number Form online

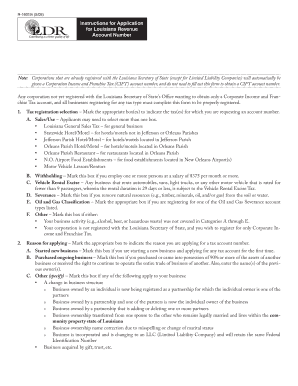

Filling out the Application For Louisiana Revenue Account Number Form online is a crucial step for businesses seeking to register for various tax accounts. This guide provides a comprehensive overview of the form's components and step-by-step instructions to assist users in completing it accurately.

Follow the steps to fill out the Application For Louisiana Revenue Account Number Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the appropriate tax registration options by marking the relevant boxes for the tax types you wish to register for, such as Sales/Use, Withholding, or Severance.

- Indicate the reason for your application by marking the corresponding box, such as starting a new business or purchasing an ongoing business.

- If applicable, enter the Louisiana account numbers for any previously registered taxes or mark 'None' if not registered.

- Provide the legal name(s) of the business as registered and any trade names utilized in operations.

- Enter the complete physical address of your business, ensuring it does not consist solely of a P.O. Box.

- Input the mailing address for correspondence, adding any alternative mailing options as per your requirements.

- Mark the type of organization that fits your business structure and provide the required U.S. NAICS code.

- Enter your Federal Employer Identification Number, or indicate 'None' if you do not have one.

- As a sole proprietor, fill in your full name, Social Security Number, home address, and daytime telephone number.

- For corporations or partnerships, provide the names, Social Security Numbers, home addresses, and telephone numbers of all officers and partners.

- Include your Louisiana charter number and state of incorporation if you are incorporated.

- List permit numbers and their expiration dates as required.

- For corporations, indicate the date the charter was filed and select whether it is a domestic or foreign corporation.

- List the date your business begins sales operations for sales or use tax purposes.

- For withholding tax registration, enter the date when your business becomes liable for withholding tax.

- Complete the entry for severance tax with the relevant date and select the appropriate filing frequency.

- Provide a brief description of your business, detailing its purpose or activities as per the guidelines.

- Finally, ensure that you sign and date the application, and if someone else prepared it, their signature is also required. Save any changes, download or print the form, and submit it to the Louisiana Department of Revenue.

Start filling out the Application For Louisiana Revenue Account Number Form online today to ensure your business is properly registered.

Your employer account number in Louisiana is a unique identifier assigned by the Department of Revenue. This number is different from your business's federal employer identification number. To find this number, you may need to access the Application For Louisiana Revenue Account Number Form or contact the Louisiana Department of Revenue directly. If you're unsure, uslegalforms can provide the resources you need to clarify your status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.