Loading

Get Indiana State Form 43731

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana State Form 43731 online

Filling out the Indiana State Form 43731 online is an essential step for individuals seeking to evaluate their competency as a nurse aide. This guide provides a clear and supportive process for completing the application seamlessly.

Follow the steps to successfully complete the Indiana State Form 43731

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

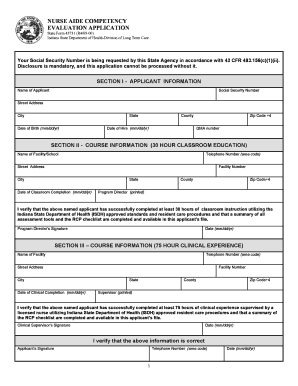

- Complete Section I - Applicant Information, which includes your name, Social Security number, address, date of birth, county, date of hire, zip code, and QMA number. Ensure that all entries are accurate to avoid processing delays.

- Fill out Section II - Course Information (30 Hour Classroom Education). Input the name of the facility/school, facility number, address, and the date of classroom completion. The program director must also print their name and provide a signature, along with the date of signing.

- Proceed to Section III - Course Information (75 Hour Clinical Experience). Enter the details about the facility where your clinical experience took place, including the facility number, address, and date of clinical completion. The clinical supervisor must print their name and sign, indicating their verification of your experience.

- In Section IV - Applicant’s Test Status, mark the appropriate boxes to disclose your test status, such as completion of Indiana training or status as a foreign nurse. Provide any necessary details as required.

- Complete Section V - Test/Monitor Information for each test taken. For up to three test numbers, include the test entity, test monitor, test site, test date, and the results of the written, oral, and skills tests. Document these accurately.

- After filling out all sections, review the entire form for accuracy. Save your changes regularly. Once completed, you can download, print, or share the form as needed for submission.

Begin your document preparation by filling out the Indiana State Form 43731 online today!

Your Indiana county of principal employment is determined by where you work most of the time or where your employer's office is located. This information is important for tax withholding purposes, so check your official employment documents or your employer for clarity. If you require additional guidance or templates for reporting, consider resources on US Legal Forms that can help clarify your employment situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.