Loading

Get Ct Ifta 2 Form 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Ifta 2 Form online

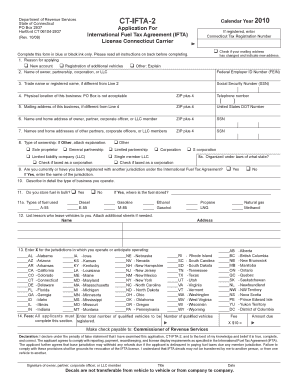

The Ct Ifta 2 Form is an essential document for Connecticut carriers applying for an International Fuel Tax Agreement license. This guide provides clear, step-by-step instructions for users to fill out the form online, ensuring a smooth and efficient application process.

Follow the steps to complete your Ct Ifta 2 Form effectively.

- Press the ‘Get Form’ button to obtain the Ct Ifta 2 Form, which will open in your preferred online editor.

- Indicate the reason for applying by checking the appropriate box for new accounts, registration of additional vehicles, or any other relevant reason. Also, if your mailing address has changed, provide the new address.

- Enter the full name of the owner, partnership, corporation, or LLC along with the Federal Employer ID Number (FEIN) in the specified fields.

- If the trade name or registered name differs from the owner’s name, provide that name along with your Social Security Number (SSN).

- Provide the physical address of the business, ensuring that it does not include a PO Box, and enter the ZIP plus 4 code and telephone number.

- If the mailing address differs from the physical location, fill in the mailing address of the business and provide the corresponding ZIP plus 4 code.

- Input the name and home address of the owner, partner, corporate officer, or LLC member along with their SSN.

- List any additional partners, corporate officers, or LLC members along with their home addresses and SSNs as needed.

- Specify the type of ownership for the business by checking the appropriate box and providing details about the state laws under which the business is organized.

- Indicate whether you have been registered with another jurisdiction under IFTA and provide the name of that jurisdiction if applicable.

- Describe the type of business operations conducted, and indicate if you store fuel in bulk, including the type of fuel used.

- List any lessors who lease vehicles to you with their names and addresses, attaching additional sheets if necessary.

- Mark the jurisdictions where you operate or expect to operate by entering an 'X' in the relevant boxes.

- Fill in the total number of qualified vehicles to be registered and calculate the applicable fees.

- Sign the declaration affirming the accuracy of the information provided, and include the date and title.

- Review the completed form for accuracy, save changes, and then choose to download, print, or share it as required.

Complete your Ct Ifta 2 Form online today and ensure your compliance with the International Fuel Tax Agreement requirements.

Filing IFTA in Missouri involves completing the required Ct Ifta 2 Form, which you can find on the Missouri Department of Revenue website or through USLegalForms. Make sure to gather all necessary details about your mileage and fuel purchases. After filling out the form, submit it online or by mail to ensure compliance with Missouri's IFTA regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.