Loading

Get Ct 4422 Uge Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 4422 Uge Form online

Filling out the Ct 4422 Uge Form online is an essential step in requesting the release of an estate tax lien in Connecticut. This guide will provide you with clear and concise instructions to help you navigate the form accurately and efficiently.

Follow the steps to complete the CT-4422 UGE form effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

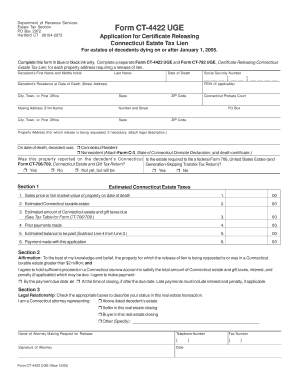

- Enter the decedent’s first name and middle initial, followed by their last name, date of death, and social security number. Include the Federal Employer Identification Number (FEIN) if applicable.

- Provide the decedent's residence address at the date of death. Fill in the street address, city, town, or post office, along with the state.

- Indicate the mailing address, which can be a firm name if applicable. Include the number and street, city, town, or post office, state, and ZIP code.

- State the Connecticut probate court information and the associated postal box.

- Fill in the property address for which the release is being requested and attach the legal description if necessary.

- Select whether the decedent was a Connecticut resident or nonresident. If nonresident, ensure to attach Form C-3 and a death certificate.

- Answer the questions regarding if the property was reported on the decedent’s estate tax return and if the estate is required to file a federal Form 706.

- Section 1: Provide the estimated Connecticut estate taxes by filling out the sales price or fair market value of the property, the estimated taxable estate, prior payments made, and the balance to be paid. Ensure to round off to whole dollars as instructed.

- In Section 2, affirm the statements regarding the estate's value and your agreement to hold sufficient proceeds in a Connecticut escrow account. Check the applicable payment agreement box.

- Section 3 requires you to check the appropriate boxes to describe your legal relationship to the transaction. Fill in your name, contact information, and provide your signature and date.

- Once all sections are complete, review the form for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your estate tax lien release documents online today to ensure a smooth process.

Filing CT OS 114 online is straightforward and involves visiting the official Connecticut state website for electronic submissions. You will need to provide necessary information and follow the prompts for a successful filing. To ensure a complete process, consider any related forms, such as the CT 4422 Uge Form, for lien situations that may need immediate attention.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.