Loading

Get Ct Ifta 2 Form 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Ifta 2 Form online

Filling out the Ct Ifta 2 Form online can be a straightforward process when approached step-by-step. This guide will help you navigate each section of the form, ensuring that you provide the necessary information accurately and completely.

Follow the steps to successfully complete the Ct Ifta 2 Form online.

- Press the ‘Get Form’ button to access the Ct Ifta 2 Form and open it in your preferred online editor.

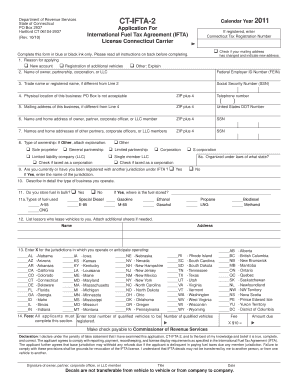

- Indicate the reason for applying by selecting the appropriate box for a new account or registering additional vehicles. If applicable, provide any other reasons.

- In the second line, enter the full name of the owner, partnership, corporation, or limited liability company (LLC). If registered, include your Connecticut Tax Registration Number.

- Complete the third line with the trade name or registered name if it is different from the name you provided in line two.

- Fill in the fourth line with the physical location of your business, ensuring no PO Boxes are used.

- If your mailing address differs from your physical address, complete the fifth line with your mailing details.

- On the sixth line, provide the name and home address of the owner, partner, corporate officer, or LLC member.

- Document the names and home addresses of any other partners, corporate officers, or LLC members in the seventh line.

- Choose the type of ownership from the provided options in line eight. If you select ‘Other,’ attach an explanation.

- State whether you are currently or have been registered with another jurisdiction under IFTA in line nine, and if so, provide the name of that jurisdiction.

- Describe the type of business you operate in line ten.

- Indicate if you store fuel in bulk in line eleven and specify the location if applicable.

- In line twelve, list the lessors who lease vehicles to you, and attach additional sheets if necessary.

- Select the jurisdictions in which you operate or expect to operate in line thirteen.

- Complete line fourteen by entering the total number of qualified vehicles to be registered and calculate the amount due.

- Finally, sign the form, including your title and the date, ensuring all information is accurate before submission.

Complete your Ct Ifta 2 Form online today for a smooth application process.

To get the CT tax form, including the Ct Ifta 2 Form, visit the Connecticut Department of Revenue Services website. You can find the necessary forms available for download, or you may choose to use an online tax preparation service. By using tools like uslegalforms, you can streamline your preparation process for state taxes and ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.