Loading

Get Solicitud De Prrroga Para Rendir El Comprobante De Retencin ... 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

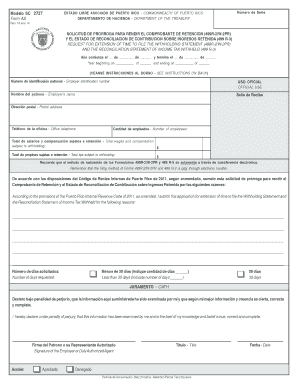

How to fill out the solicitud de prórroga para rendir el comprobante de retención online

This guide provides clear, step-by-step instructions for filling out the solicitud de prórroga para rendir el comprobante de retención form online. Designed for users with varying levels of experience, it aims to make the process straightforward and accessible.

Follow the steps to complete your solicitud de prórroga online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the year for which you are requesting an extension at the top of the form, specifying the beginning and ending dates.

- Fill in your employer identification number in the designated field. This number is crucial for processing your request.

- Provide your name as the employer in the appropriate section.

- Complete the postal address field with your current mailing address to ensure proper communication.

- Input your office telephone number so that the Department of the Treasury can contact you if necessary.

- Fill in the number of employees you have in the specified section.

- Provide the total of wages and compensation subject to withholding. Ensure the amount is accurate and reflects the reporting period.

- Enter the total amount of tips subject to withholding, if applicable.

- In the section for reasons for requesting an extension, clearly explain why you require additional time. Use concise and relevant information.

- Indicate the number of days for which you are requesting the extension, ensuring it does not exceed 30 days.

- Complete the oath by signing the form, confirming that the information provided is true and correct.

- Once all required fields are completed, save changes to your document. You may also download, print, or share the completed form as needed.

Begin your request and complete your documents online today.

Pedir una prórroga en el IRS implica llenar adecuadamente el Formulario 4868. Debes enviarlo antes de la fecha límite de presentación para obtener esa extensión de tiempo. Además, asegúrate de comprender las consecuencias de no pagar impuestos adeudados, ya que esto no se extiende con la prórroga. Es un paso crítico para gestionar tu Solicitud De Prrroga Para Rendir El Comprobante De Retencin.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.